Image credit: Mikhail Nilov via Pexels

On the face of it, writing an invoice should be a straightforward task for any sole trader or business. It also comes with a strong incentive. Any business or service will need to create a valid invoice so they can be paid.

However, writing an invoice in Australia comes with another level of understanding. Unfortunately no matter the size of the business, invoicing is something that is often overlooked or done inefficiently.

First there are the basics and there are myriad resources online to take you through the logistics of creating one.

Even if you’re just starting out, it can be useful to start using accounting software right from the outset. This will help with business processes and, importantly, ensuring you’re getting paid.

Here we outline what an invoice should look like, and how to set up your businesses processes to support good invoicing.

Invoicing basics: what it looks like

There are two ways to invoice in Australia.

1. Tax invoicing — If you are registered for the Goods & Services Tax (GST) you will need to include this and details on each item and is referred to as a “tax invoice”.

2. Regular invoicing — If you aren’t registered for GST your invoice does not include a taxable component and is known as simply an “invoice”.

Do I need to write ‘tax invoices’?

You need to register for GST if your business has a turnover of $75,000 or more, or if you are a not-for-profit with a turnover of $150,000 or more.

If you are registered for GST you’ll need to use a “tax invoice”.

The Australian Government has great resources at its business website:

https://www.business.gov.au/Registrations/Register-for-taxes/Tax-registration-for-your-business

What is needed on the invoice?

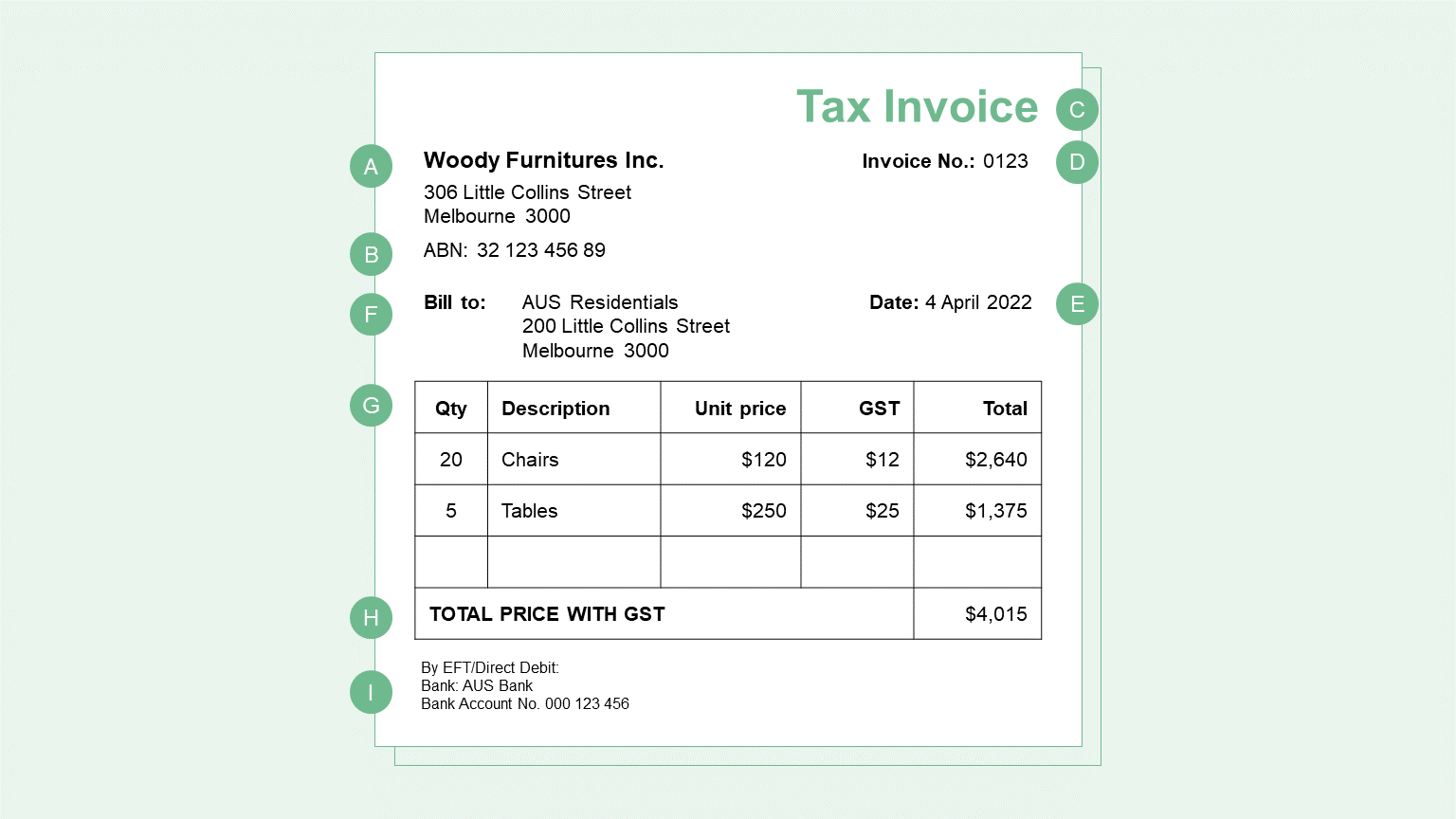

Creating a Tax Invoice:

- Your business name (at the top)

- The Australian Business Number (ABN) or Australian Company Number (CAN) near the business name

- The term ‘Tax invoice’ at the top (not just ‘Invoice’)

- An invoice number alongside the word ‘Tax invoice’

- The date you’re issuing the invoice at the right-hand side

- For goods and services costing $1,000 or more in total, put the name of the person/company receiving your goods and services

- A description of each good and/or service provided and the quantity sold

- Either the:

-

- GST inclusive price with a statement to the effect that ‘all prices include GST’; or

- GST-exclusive price for the goods and services showing the total for the goods and services and the GST total as a separate line item

- GST inclusive price with a statement to the effect that ‘all prices include GST’; or

-

- Terms of payment details (how and by what date the invoice should be paid, including your business’ bank account or BPAY information).

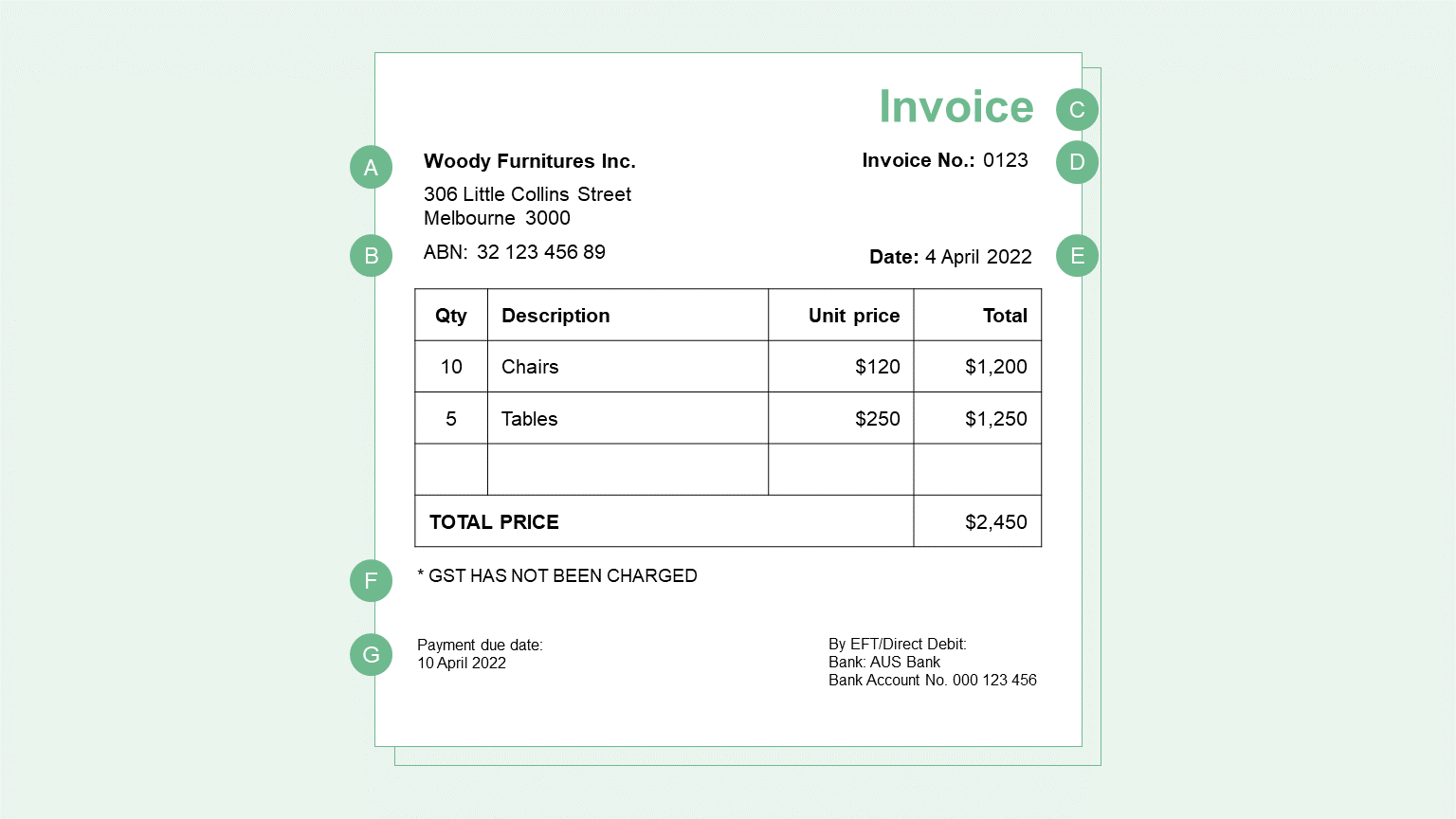

Creating a Regular Invoice:

- Your business name (at the top)

- The Australian Business Number (ABN) or Australian Company Number (CAN) near the business name

- The word ‘Invoice’ stated prominently at the top

- An invoice number alongside the word ‘Invoice’

- The date on which you’re issuing the invoice

- The statement ‘GST has not been charged’ sitting prominently at the bottom

- Terms of payment details (how and by what date the invoice should be paid, including your business’ bank account or BPAY information).

All set? Now make sure your invoice gets paid.

Getting paid is one of the most important things to manage in a business and is why we send an invoice at all, but not many people set this up well.

We will look at the simple business processes you need to ensure you are paid on time.

- Regular (or one-off) invoicing — Invoice on a consistent schedule (monthly or more regularly) to ensure regular payments.

- Set reminder emails — If you haven’t been paid, ensure you have a process to send a reminder or to chase late payers.

- Payment terms — Negotiate these as needed for your business structure. A typical invoice can have from 7-30 days payment terms, or more if you’re dealing with larger companies.

- Connect quotes and invoices — where relevant get a quote for your work signed off, so the invoice is understandable and straightforward.

- Use the best tools — Using accounting software is extremely helpful to keep track of the times, terms and due dates of invoice. It’ll also be helpful at tax time!

Invoicing well is one of the most important things a business can do. Set yourself up well, and it will mean being set up well for growth too!

We hope this article provided you some insights to better understand your business needs. If you have any questions, we’d love to answer them. Contact us today!