In business timing is everything, especially when it comes down to the basics of how you manage your money.

In accounting terminology, SME owners have the option to manage their business finances either on a cash basis or through accrual accounting.

These are both very important to understanding your business fundamentals.

As we will explain, accruals accounting can help business owners feel more at ease than reporting on a cash basis.

The reason is that the former provides a better picture of what the underlying business is doing rather than just tracking cash in and out, which often doesn’t reflect the performance of the business. Cash accounting means your performance could be overstated or understated depending on when you’re looking at your accounts.

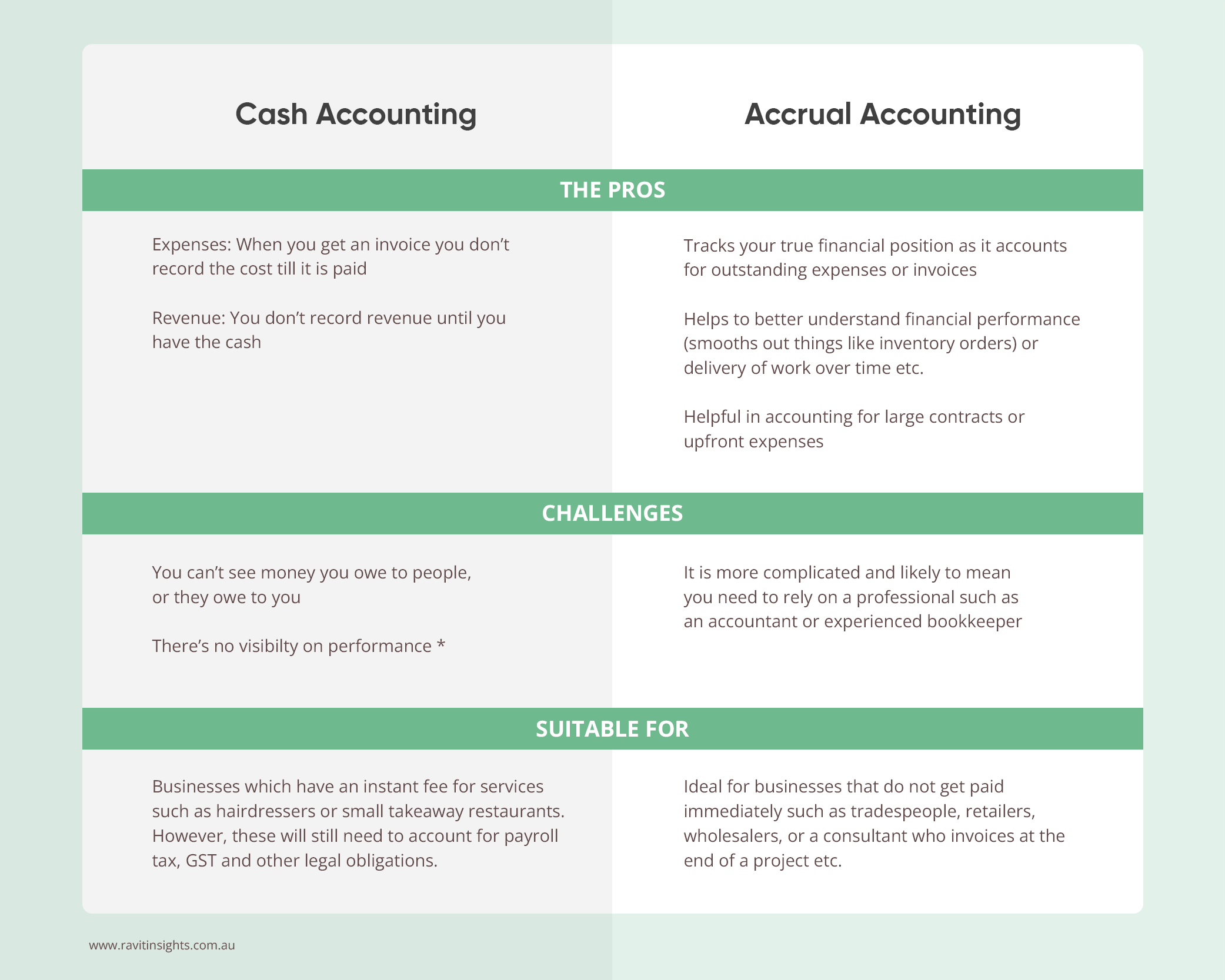

What’s the difference between cash and accrual?

The difference between cash and accrual is in the timing.

Cash basis accounting is used when you recognise the money only once it has changed hands, put simply, when it is in or out of your bank account. That means looking at expenses when they are paid, and invoices when the money comes in.

By contrast accrual accounting recognises your performance, by tracking revenue when it is earned and expenses when they are billed – regardless of when they are paid.

Which accounting method is used by SMEs?

Cash accounting is often the default method used by SMEs, especially those on the smaller side, as it is the minimum requirement for quarterly reporting purposes, and it is also much simpler to manage.

But that doesn’t mean it’s the right thing to do. While simplicity is a good thing, it can come unstuck as business owners may lose sight of the underlying business performance.

The benefit of modern accounting systems like Xero or MYOB is that it is now easier to manage both (accruals and cash) so you get the best of both worlds – reporting on a cash basis but still being able to see your performance and position. However, it is still essential to have a good understanding of what each means.

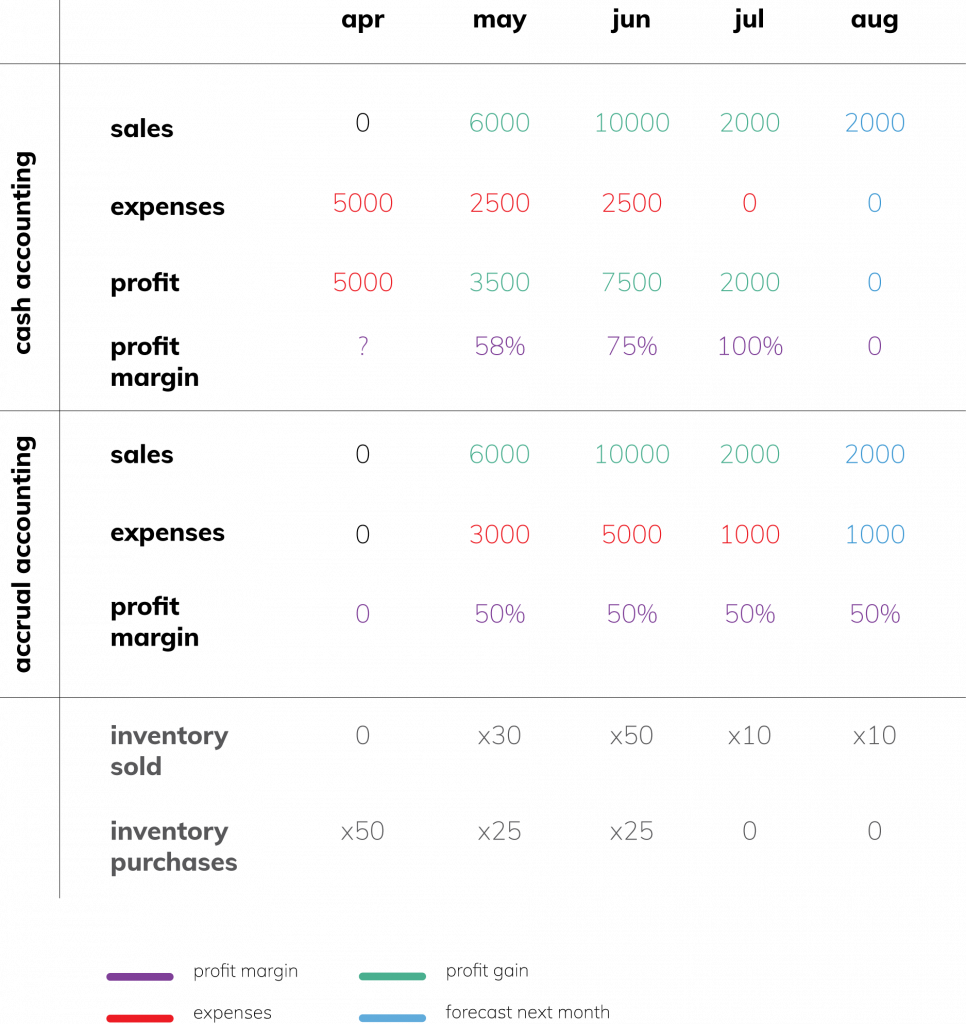

An accounting case study

Olive, who is a small sporting goods retailer, buys 100 sets of skis over a three month period (x50 in April, x25 in May, x25 in June). She sells them for $200 each (x30 in May, x50 in June, x10 in July and x10 in August)

The difference between cash accounting and accrual accounting is displayed in the table below.

The key difference is the timing of when the cost of goods sold is accounted for. As you can see, in the ‘cash accounting’ method, the cost of goods sold is accounted for as soon as they are purchased and paid for however in the ‘accrual accounting’ method, the cost of goods sold is accounted for only when the goods are sold. As a result, the ‘accrual accounting’ method provides a more accurate reflection on the business’s performance where as the ‘cash accounting’ method focuses purely on how much cash is moving in and out of the business and not necessarily how the business is performing.

Another thing to look at is how the profit margin (profit/sales) is reflected in each method. Olive’s business is purchasing skis at $100 and selling them for $200 each. That is a 50% profit margin however, when you look at the scenario from a ‘cash accounting’ perspective, the profit margin appears to fluctuate every month but that is not the actual case.

There are flow-on effects to broader business management no matter which you take.

Cash vs Accrual accounting

Cash accounting is a simple method of bookkeeping that keeps track of the cash coming in and out.

Accrual accounting is a more complicated method of accounting, and you may need to get external assistance to help. It means you record expenses and sales when they take place, rather than just the cash transactions, which means you can keep track of who you owe money to, and who owes money to you.

*If we refer to the above case study, at the start of the season it appears that the business has performed terribly on a cash basis – ordering stock, but once it makes a sale then it is likely to have improved its cash position. However, this position then neglects the fact that it will still have stock on hand, impacting the profitability of trade.

How to pick the best accounting method

To choose the method right for you, ensure you understand how your business works and what you need to accommodate for.

You might want to consider:

- The size of your business

- Complexity and timeline of your transactions and processes

- Whether you have the resources to manage more complicated accounting

- Whether there are likely to be reporting requirements

- Future needs including funding from banks or other lenders. Having accruals accounting will help to improve the demonstration of sophistication of accounting practices and improve the business’s likelihood of being granted funding.

As always, a great first step is to speak with your accountant about whether you need to consider a different way of managing your business finances.

Was this article helpful? If you’ve got any questions, feel free to send us a message. We are more than happy to help you through your financial management and planning journey.